For electrical businesses, cash flow isn’t just a financial metric; it’s the lifeblood of your operations. Keeping the current flowing in your business is as crucial as maintaining electrical circuits. In this article, we’ll delve into why cash flow is king for your electrical business. We’ll explore the significance of consistent cash flow, its impact on daily operations, and strategies to ensure the financial health of your electrical enterprise.

Considerations for Cash Flow in Your Electrical Business

- Fueling Daily Operations: Cash flow is the fuel that powers your daily operations. It ensures you can pay your technicians, purchase materials, cover overhead expenses, and keep the lights on in your office. Without a steady stream of cash, your electrical business may struggle to meet these essential financial commitments.

Consider the scenario where you need to purchase new equipment for an upcoming project. A healthy cash flow allows you to make this investment promptly, enhancing your efficiency and service quality. Conversely, a cash flow shortage could lead to delays, lost opportunities, and a negative impact on your reputation.

- Managing Seasonal Fluctuations: Electrical businesses often face seasonal fluctuations in demand. Cash flow serves as a buffer during slow seasons, ensuring you can weather the storms of reduced income. It provides the financial resilience needed to cover fixed costs and payroll, even when project bookings temporarily decline.

During peak seasons, cash flow allows you to seize opportunities for growth. You can invest in marketing, training, or expanding your service offerings, knowing that you have the financial resources to support these initiatives.

- Securing Your Business’s Future: Maintaining strong cash flow isn’t just about the present; it’s about securing your business’s future. A positive cash flow position enables you to plan for long-term growth and sustainability. It allows you to reinvest in your business, whether by hiring additional skilled electricians, upgrading your technology infrastructure, or expanding into new markets.

Moreover, having robust cash reserves provides a safety net in emergencies. Whether it’s an unexpected repair on a company vehicle or a sudden economic downturn, having cash on hand ensures your business can withstand unforeseen challenges without resorting to loans or debt.

- Building Business Credit: Sound cash flow management can help your electrical business build a strong credit history. Consistently meeting financial obligations and paying bills on time enhances your business’s creditworthiness. A positive credit profile can open doors to favorable financing options, lower interest rates, and better terms when seeking loans or lines of credit for strategic investments.

- Strategies for Improving Cash Flow: Improving cash flow requires a combination of strategies and diligent financial management. Consider implementing the following tactics:

a. Invoice promptly: Send invoices promptly after completing projects to accelerate receivables.

b. Offer multiple payment options: Provide clients with various payment methods, making it convenient for them to settle invoices.

c. Monitor expenses: Regularly review your expenses and identify areas where cost-saving measures can be applied.

d. Implement efficient billing systems: Streamline your billing and invoicing processes to minimize administrative delays.

e. Create a cash flow forecast: Develop a comprehensive cash flow forecast to anticipate financial trends and prepare for future challenges.

Conclusion

In the electrical industry, cash flow isn’t just king; it’s the foundation upon which your business stands. By recognizing its pivotal role in daily operations, managing seasonal fluctuations, and planning for long-term success, you can ensure that cash flow remains a formidable ally in growing and sustaining your electrical enterprise. Moreover, adopting effective strategies for improving cash flow will help keep your business financially robust and resilient in the face of changing economic landscapes.

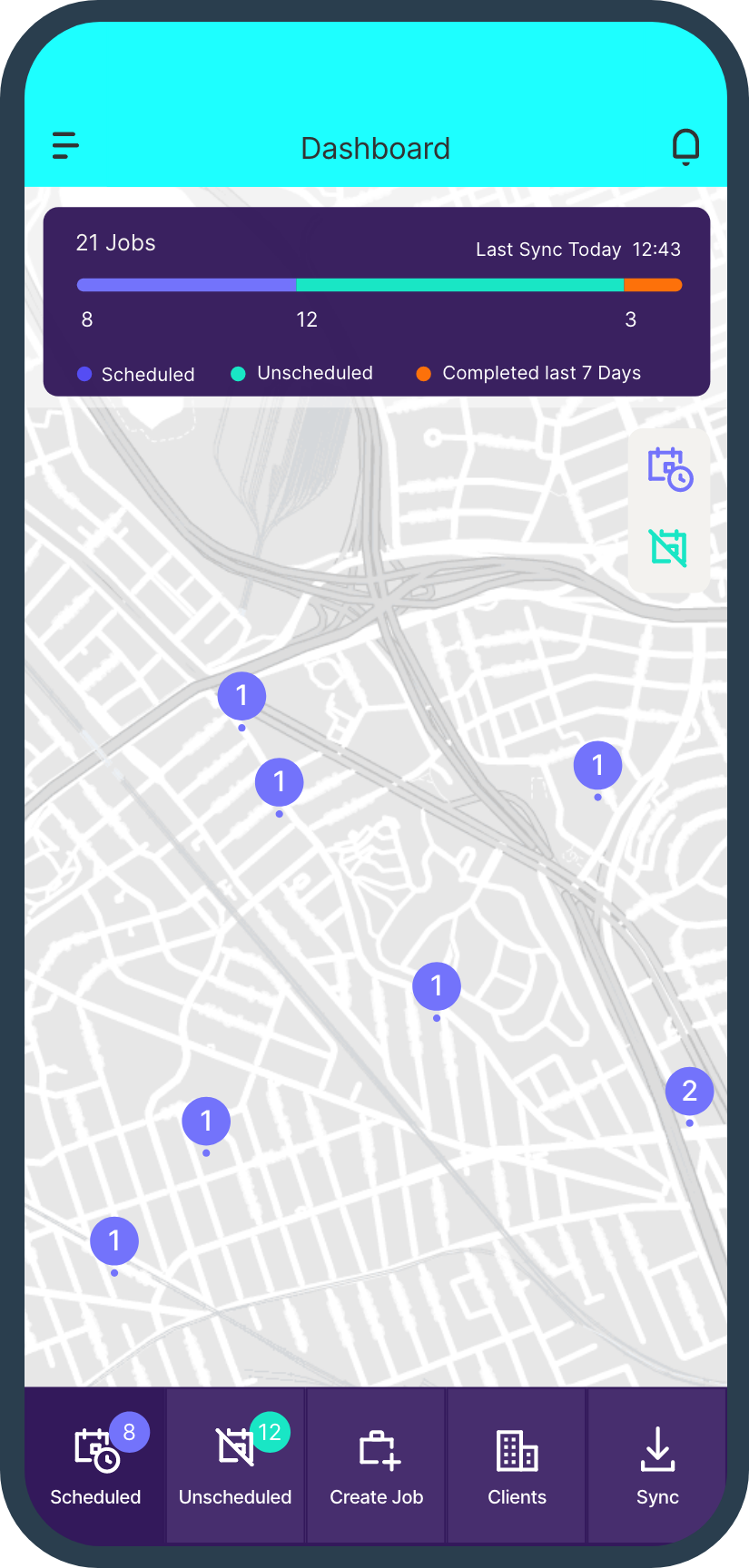

Klipboard offers a powerful solution to streamline cash flow management for your electrical business. With our intuitive job management platform for electricians, you can easily track jobs, invoices, and payments in real time, ensuring you have full visibility over your financials. By automating key processes, you save valuable time and reduce the risk of errors, allowing you to focus on what matters most—growing your business.

Don’t let cash flow challenges hold you back. Sign up for Klipboard today and take control of your finances with ease.