Healthy cash flow is the sign of a healthy business. It allows you to set the foundations of success, by enabling you to buy the best materials, invest in new equipment and supporting your team.

Here’s five quick and easy actions you can take today to improve your service business cash flow.

5 quick and easy actions to improve your service business cash flow

1. Always run a credit check on a new customer

Congratulations your quote was accepted and you have secured the job.

Your first instinct might be to schedule in the work and communicate this with your team.

Stop. Run a credit check on the new customer first.

There is such a thing as a bad customer. A customer that costs you time, materials, effort and hours of work, only to withhold payment.

Before you get down to the business of providing them with a great service make sure they are worth your time.

By avoiding customers who fail simple and easy to do credit checks you’ll be able to focus more time on those who pay their invoices promptly, helping you to improve your service business cash flow.

2. Offer incentives for early payments

Payment today is better than a promise of more tomorrow.

It may only have to be a small percentage off the invoice, but it could be enough to ensure your customers don’t delay in paying you for the completed work.

What you lose in revenue for the small discount you save in the hours you have to spend chasing for payment, the disruption this means to your finance team and the cost of not having that cash flow available for investment in your business.

Offers and incentive not only improve your service business cash flow by reducing the time for an invoice to be paid, it also doubles up as marketing activity helping you potentially win new business.

3. Don’t hold onto an invoice

Why not send it as soon as the work is completed?

Getting into the habit of sending invoices immediately after a job is completed will help shorten the time it takes to go from a booking to payment on that job.

You may have your reasons for holding back, perhaps the customer has asked for more time or you have a batch of invoices, so you think it might be better to do them all in one go.

Every day you hold off sending the invoice is another that you didn’t have that cash available.

4. Build better relationships with your suppliers

Building a good relationship with suppliers will benefit your business in the long term. Improved rapport with suppliers will likely benefit you with preferential pricing and VIP terms.

If you regularly order parts that are occasionally difficult to obtain when supply is low, you’ll most likely be notified when the next order is coming in.

Consider the challenges of the supplier’s business and what they want from their customers. While your motivation is to reduce prices and improve your service business cash flow, they want predictable, steady and reliable revenue. Make sure they understand the scale of your business, who your customers are and the parts you need.

Remember this is a two way relationship. They are business owners like you and experience the same challenges.

5. Improve your forecasting

Better oversight of your field service finances will help you improve your service business cash flow.

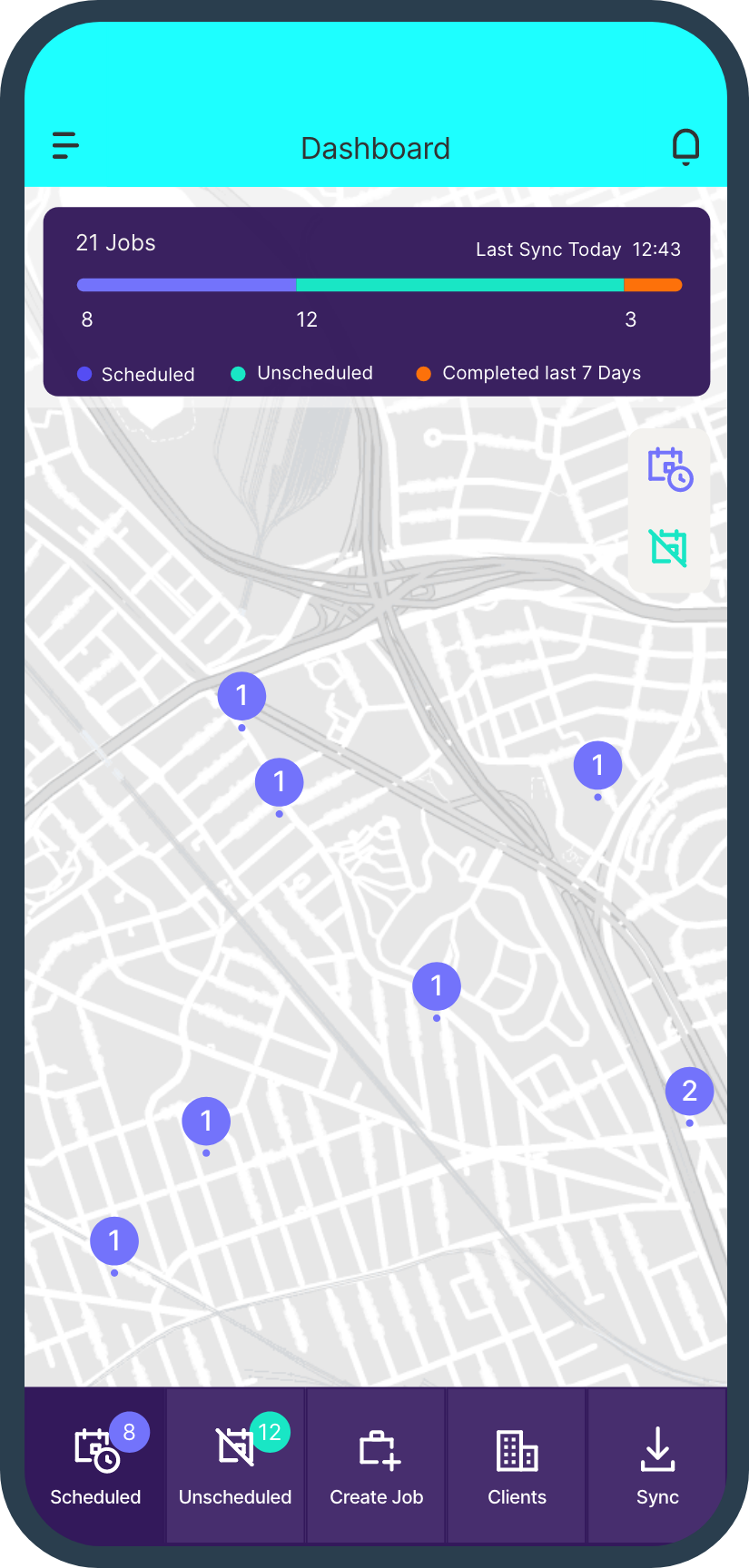

Many Field Service businesses use Job Management Software with Finance tools to help them forecast more effectively.

When you’ve got greater visibility of the quotes you’ve sent, won or lost, you’ll have a more predictable cash flow. Many Job Management Software providers offer a free trial period so you can start making a change today.

You can’t predict the future but you can plan for it.

What does a healthy cash flow mean for a Field Service business?

Without a steady and reliable cash flow, you’re likely to be unable to offer your customers the service they expect.

Any unexpected expense could be very costly and it limits your opportunity to react when you need to.

For example if your client’s asset has a breakdown that requires you to get an expensive part from a supplier, without cash flow you may struggle or have to use more expensive methods, such as loans or credit lines.

Why a cash flow forecast is important for service businesses?

Forecasting helps you get a good idea of when your customer’s invoices are likely to be paid. That will enable you to reinvest and plan around that money.

With visibility of a forecast you can’t plan, in fact without it you have no plan at all.

To carry out the tasks of servicing, repairing and replacing your clients equipment requires you to be agile. To react when they need you and know you have the skills and parts available to get their equipment operational again.

How to improve your service business cash flow by setting up better forecasting

The easiest way to get a forecast is to have all your Field Service finances in one place.

You need to be able to see at a glance, what quotes have been sent, what’s been accepted and which invoices are due payment.

The old fashioned way of doing this was using Finance Software from the 90s!

Complex spreadsheets that still required you to carry out financial reconciliation so that your job records matched your invoices.

Today, things are a little more streamlined.

Many Service businesses are using a combination of Field Service Management Software for their jobs and online business finance software such as Xero and Quickbooks for accounting.

Adding Job Management Software to your service business to streamline your operation both in the field and the office is simple. Click here to see what Klipboard can do for you.

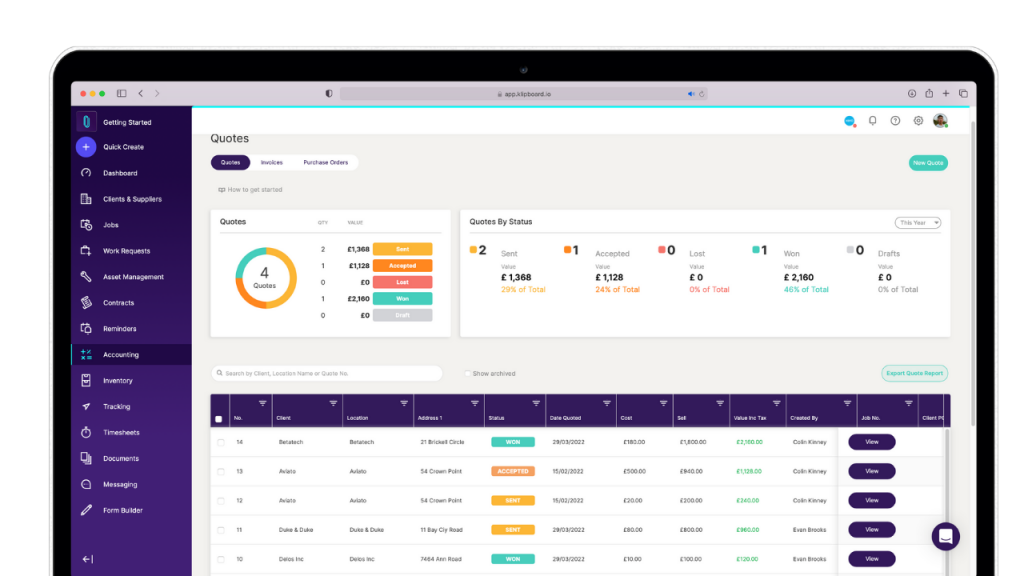

How Job Management Software and Accounting Software can simplify cash flow forecasting

The modern approach to improve cash flow forecasting is to use a combination of Job Management Software and Accounting Software to instantly reconcile your Field Service finances.

There’s three key benefits to using both systems:

- You don’t have to duplicate your data entry. All the details you add for your jobs, such as client details, line items, and dates are instantly passed over saving hours of work every week.

- You can instantly see the total value of the quotes and invoices you have on your jobs.

- Gain a better understanding of the profitability of each job

The biggest change to Field Service software over the last couple of years, is how accessible productivity and operational efficiency software is for those seeking to make improvements to their business.

Improve your service business cash flow today by making a few quick and easy changes to how you manage your Field Service finances and use software to streamline your operation.